Have you become puzzled by the implications of “probate” and “non-probate” assets? These are critical concepts that significantly impact the estate distribution process. Yet, they often remain muddled in people’s minds.

This article breaks down the fundamental differences between probate and non-probate assets. This knowledge is crucial in planning an efficient and effective estate plan. Empower yourself with these essential details and take the first step towards wise estate planning and management.

Defining Probate Assets

Probate assets are subject to the probate procedures of your local judiciary. Some common examples include real estate, bank accounts, investments, vehicles, and other valuable items. Additionally, these items may not have a designated beneficiary or a joint owner who automatically assumes ownership. This status means they require court supervision to ensure a lawful transfer to another party.

One of the most common types of probate assets is solely-owned property. This category includes anything the decedent has not assigned to someone else upon their death. It could be a house, a car, a piece of land, or personal belongings. Even certain financial assets like bank accounts or investment portfolios can apply.

The share of the property passes to the surviving owner when there is a right of survivorship for joint assets. However, this transfer does not happen in cases of tenancy in common.

Defining Non-Probate Assets

Non-probate assets refer to anything that can go to heirs without going through the courts. They bypass probate because they have specific mechanisms in place. A few notable examples include the following:

- Anything held in joint tenancy with the right of survivorship

- Life insurance policies

- Retirement accounts (like IRAs or 401(k)s)

- Payable-on-death or transfer-on-death accounts

- Trust assets

Comparing Probate and Non-Probate Assets

The categorization of assets as probate or non-probate can dramatically impact estate administration.

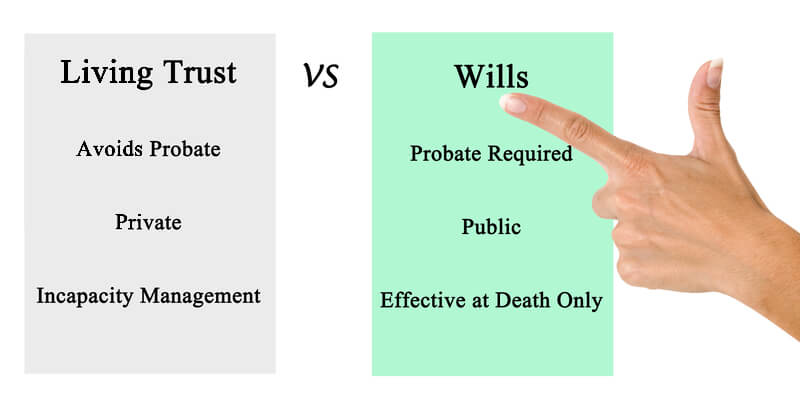

For instance, the time frame for asset distribution also differs. The probate process can be time-consuming, often taking months to years. Conversely, non-probate assets typically transfer to the designated beneficiaries much more quickly, often within weeks of death.

Probate and non-probate assets are usually in the deceased’s gross estate for federal estate tax purposes. However, effective estate planning can reduce this burden.

Privacy considerations are another notable difference. After all, probate is a public process. Wills become public record, and information about the deceased’s assets become accessible to anyone. Non-probate transfers, on the other hand, are generally private.

Finally, it is vital to consider the cost implications. The probate process can be costly between court fees, executor fees, and other administrative costs. They can consume a substantial portion of the estate. Non-probate assets bypass these costs by avoiding the probate process entirely.

The Role of Probate and Non-Probate Assets in Estate Planning

Identifying and managing probate and non-probate assets can directly affect the effectiveness of an estate plan. Recognizing which assets are likely to go through probate and which can bypass this process allows for a more strategic approach.

Generally, the more non-probate assets in an estate, the less it goes through the judicial process. This arrangement can save time, reduce costs, and provide more privacy.

Given the complexities and potential implications of mismanaging probate and non-probate assets, the assistance of legal counsel and estate planning experts is invaluable. These professionals can help avoid common pitfalls and ensure the estate plan provides the desired outcome. Moreover, as laws change, these professionals can provide updated advice and help modify as needed.

Potential Risks and Pitfalls

Misclassifying assets during estate planning can have severe repercussions. Improper classifications can create delays, public scrutiny, and additional expenses. Similarly, some items may bypass the will’s directives and potentially derail the distribution plan. Furthermore, improper classification can lead to underestimating the estate’s value.

The impact extends to heirs and beneficiaries. After all, they could experience delays in receiving their inheritance. Misclassification can also disrupt an equitable distribution of assets among multiple heirs. This confusion may create substantial conflicts among family members. You can help to avoid this in advance by solving some common probate challenges.

Both probate and non-probate assets generally count towards the gross value of an estate for federal estate tax purposes. Still, incorrect classification could result in inaccurate tax calculations and potential penalties.

Talk to a Local Probate Attorney

These two types of assets have distinct impacts on estate administration. These plans are complex, and the laws can be intricate or vague. Therefore, professional advice is invaluable in navigating these challenges. Professional help may even provide alternatives and teach you how to avoid probate.

You can ensure your estate plan aligns with your wishes and serves the best interests of your heirs. If you’re unsure where to start, don’t hesitate to ask for a referral to a local probate lawyer. They can guide you through the intricacies and help secure peace of mind.

Call us at (866) 345-6784 anytime to speak to a representative or complete our online form!